Difference between revisions of "Investments"

Vinkesteijn (talk | contribs) |

Vinkesteijn (talk | contribs) |

||

| Line 17: | Line 17: | ||

Looking at the market and the cost structure, a maximum investment of € 900,000 per year is advised by the accountant of the hotel. Of course, here needs to be an exact plan on what to use this money for. There is no worry about financing these kind of investments: liquidity to finance an investment of € 900,000 per year is no problem. <br> | Looking at the market and the cost structure, a maximum investment of € 900,000 per year is advised by the accountant of the hotel. Of course, here needs to be an exact plan on what to use this money for. There is no worry about financing these kind of investments: liquidity to finance an investment of € 900,000 per year is no problem. <br> | ||

Presume new investments would be linearly depreciated in 4 years without any residual value, we would see | Let's have a look at an investment of € 900,000 per year. Presume the new investments would be linearly depreciated in 4 years without any residual value, we would see costs as in the table underneath. | ||

<table border=1 cellpadding=8> | <table border=1 cellpadding=8> | ||

<tr><th> | <tr><th>Investments and depreciation</th></tr> | ||

<tr><td>'''Year'''</td><td> Investment</td><td> Additional yearly | <tr><td>'''Year'''</td><td> Investment</td><td> Additional yearly depreciation</td><td>Total depreciation this year</td></tr> | ||

<tr><td>History</td><td> Not done </td><td> € 0 </td><td> € 0 </td></tr> | <tr><td>History</td><td> Not done </td><td> € 0 </td><td> € 0 </td></tr> | ||

<tr><td>Year 1</td><td> Max € 900,000</td><td> € 225,000</td><td> € 225,000 </td></tr> | <tr><td>Year 1</td><td> Max € 900,000</td><td> € 225,000</td><td> € 225,000 </td></tr> | ||

| Line 30: | Line 30: | ||

</table><br> | </table><br> | ||

But you can also choose for total different | But you can also choose for total different depreciaton systems (depending on the assets you finance) or have a different investment plan like: | ||

<table border=1 cellpadding=8> | <table border=1 cellpadding=8> | ||

<tr><th> | <tr><th>Investments and depreciation</th></tr> | ||

<tr><td>'''Year'''</td><td> Investment</td><td> Additional yearly | <tr><td>'''Year'''</td><td> Investment</td><td> Additional yearly depreciation</td><td>Total depreciation this year</td></tr> | ||

<tr><td>History</td><td> Not done </td><td> € 0 </td><td> € 0 </td></tr> | <tr><td>History</td><td> Not done </td><td> € 0 </td><td> € 0 </td></tr> | ||

<tr><td>Year 01</td><td> € 100,000</td><td> € 25,000</td><td> € 25,000 </td></tr> | <tr><td>Year 01</td><td> € 100,000</td><td> € 25,000</td><td> € 25,000 </td></tr> | ||

| Line 42: | Line 42: | ||

<tr><td>'''Total'''</td><td>'''€ 1.200,000''' </td><td> '''€ 275,000''' </td><td> '''€ 425,000'''</td></tr> | <tr><td>'''Total'''</td><td>'''€ 1.200,000''' </td><td> '''€ 275,000''' </td><td> '''€ 425,000'''</td></tr> | ||

</table><br> | </table><br> | ||

== How big should the investment be? == | == How big should the investment be? == | ||

First of all, you have to have a clear plan: what do you exactly want to do? Does this fit in with your strategy? | As stated, the hotel is getting outdated and does have the liquidity to invest. First of all, you have to have a clear plan: what do you exactly want to do? Does this fit in with your strategy? | ||

Secondly, realize that investments bring costs (the depreciation as explained above), so will | Secondly, realize that investments bring costs (the depreciation as explained above), so will the revenues compensate the costs and will, in the end, the profit go up? <br> | ||

But you do want to renovate the sauna, what does this cost? Well, check the internet, | But you do want to renovate the sauna, what does this cost? Well, check the internet, or look at similar cases. An educated guess is required, so estimate the costs yourself, based on any comparable prices you have found. Try to be realistic, but as in reality 'how much does it cost' depend on so many things and is not easy to answer. A good starting point is [http://www.emeraldforesthotel.com/dox/Hotel_Cost_Estimating_Guide.pdf estimating hotel costs]. Do not focus too much on details and looks at the depreciation costs of existing assets, now set at € 525,187. So going way above this number is risky. | ||

<hr> | <hr> | ||

Revision as of 11:29, 2 January 2020

→ Go! Category:Hotel info

Cost groups

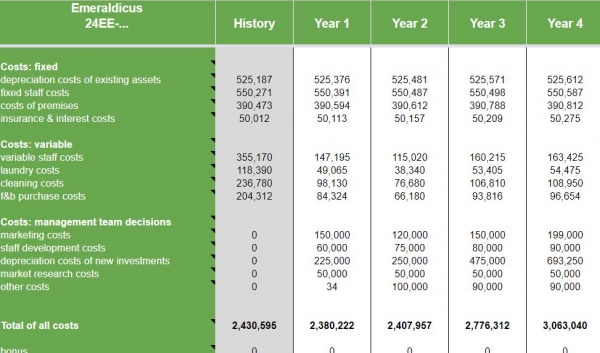

There are three major cost groups visible in the operating review after each year:

- the fixed costs have stayed the same during all four years, and the fixed depreciation costs are one of them.

- the variable costs depend on the occupancy rate

- the costs Management Team Decisions, will depend on the decisions the management team takes after taking over.

Fixed depreciation costs of existing assets

There is a number of depreciation costs of existing assets, set at € 525,187 fixed costs which you can find in the operating review and which you cannot influence. This part of the fixed costs is called depreciation costs of existing assets. You do not have to bother about this amount, though it is around 34.64% of your total of costs as you have a rather big asset. As these costs are fixed they are not influenced by the occupancy rate nor by decisions in the near future and so will stay the same all over the years.

With a mouse-over in column A you will get additional information in the original example file.

New investments

However, if you do new investments, you will get a cost group Depreciation costs of new investments on your operating review.

In your explanations, you should calculate how you want to do this.

Looking at the market and the cost structure, a maximum investment of € 900,000 per year is advised by the accountant of the hotel. Of course, here needs to be an exact plan on what to use this money for. There is no worry about financing these kind of investments: liquidity to finance an investment of € 900,000 per year is no problem.

Let's have a look at an investment of € 900,000 per year. Presume the new investments would be linearly depreciated in 4 years without any residual value, we would see costs as in the table underneath.

| Investments and depreciation | |||

|---|---|---|---|

| Year | Investment | Additional yearly depreciation | Total depreciation this year |

| History | Not done | € 0 | € 0 |

| Year 1 | Max € 900,000 | € 225,000 | € 225,000 |

| Year 2 | Max € 900,000 | € 225,000 | € 450,000 |

| Year 3 | Max € 900,000 | € 225,000 | € 675,000 |

| Year 4 | Max € 900,000 | € 225,000 | € 900,000 |

| Total | Max € 3,600,000 | € 900,000 | € 2,250,000 |

But you can also choose for total different depreciaton systems (depending on the assets you finance) or have a different investment plan like:

| Investments and depreciation | |||

|---|---|---|---|

| Year | Investment | Additional yearly depreciation | Total depreciation this year |

| History | Not done | € 0 | € 0 |

| Year 01 | € 100,000 | € 25,000 | € 25,000 |

| Year 02 | none | 0 | € 25,000 |

| Year 03 | € 200,000 | € 50,000 | € 75.000 |

| Year 04 | € 900,000 | € 225,000 | € 300,000 |

| Total | € 1.200,000 | € 275,000 | € 425,000 |

How big should the investment be?

As stated, the hotel is getting outdated and does have the liquidity to invest. First of all, you have to have a clear plan: what do you exactly want to do? Does this fit in with your strategy?

Secondly, realize that investments bring costs (the depreciation as explained above), so will the revenues compensate the costs and will, in the end, the profit go up?

But you do want to renovate the sauna, what does this cost? Well, check the internet, or look at similar cases. An educated guess is required, so estimate the costs yourself, based on any comparable prices you have found. Try to be realistic, but as in reality 'how much does it cost' depend on so many things and is not easy to answer. A good starting point is estimating hotel costs. Do not focus too much on details and looks at the depreciation costs of existing assets, now set at € 525,187. So going way above this number is risky.

→ GO! Top of this page