Operating review

→ Go! Category:Hotel info

→ Go! Running competition

Operating review

An operational review is an in-depth look at the big picture, addressing in this case especially the financial elements so to

make the choices, costs, revenues and results clearly visible.

In the administration of Emerald Forest Hotel, as we use it, no VAT Value added tax is visible. Not in the revenues, neither on the cost side. There is no record on the liquidity, balance sheets (opening nor end of the year) nor an investment plan.

We consider the revenues and the costs to be without any VAT and costs and revenues to be paid at the date they occurred.

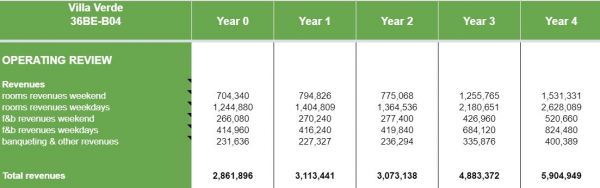

All Revenues

Revenues comprise the average (sales) prices the hotel had decided to choose, times the number of booked rooms (occupancy rate). All food and beverages are considered to be caused by these guests: so the higher the occupancy rate, the more revenues you get from food and beverages.

Banqueting and other revenues are a separated revenue unit in the hotel. The sales prices in the past varied from a minimum of € 25 to a maximum of € 30 per person. On the Banqueting page, you can find some more info, pictures, and videos on banqueting. The 'other' elements in this group are things like additional sales, renting out bikes, upgrades, cancellation fees etc. Altogether a bit more than 8% of the total revenues.

Underneath you'll find an overview which gives some more insights into the revenue structure, as far as information is available in the Bergman's administration. This all reflects the year before you take over, the history will be your starting position, the other years just give you an indication of what might happen.

| Revenues History | ||||

|---|---|---|---|---|

| Rooms | Rooms revenues weekend | € 704,340 | 24.61% | |

| Rooms revenues weekdays | € 1,244,880 | 43.49% | 68.10% | |

| Food and beverage | F&B revenues weekend | € 266,080 | 9.29% | |

| F&B revenues weekdays | € 414,960 | 14.49% | 23.78% | |

| Banqueting and other revenues | Banqueting and other revenues | € 231,636 | 8.09% | 8.09% |

| Total revenues | € 2,861,896 | 100% | 100% |

More info on page Revenues.

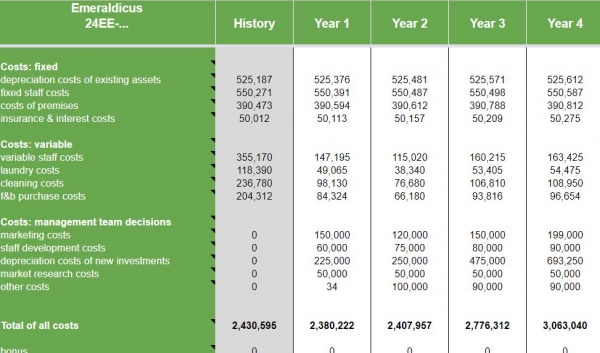

All costs

The situation below is just an example of the projections of costs for the coming four years. Again, the situations as you take over is the history (colored gray) the rest are predictions.

Underneath you'll find an overview which gives further insights into the cost structure as far as information is available in the Bergman's administration. This all reflects the situation as you take over, this will be your starting position. Especially the Cost on Management Team Decisions are missing in the relevant year History. The four test year are just a basic testing in what this could bring. For now, in the history these are all zero. These management team decisions is what has been lacking, the last few years: you cannot do without anymore.

| Costs | ||||

|---|---|---|---|---|

| Costs: fixed | Depreciation costs of existing assets | € 525,187 | 34.64% | |

| Fixed staff costs | € 550,271 | 36.29% | ||

| Costs of premises | € 390,473 | 25.75% | ||

| Insurance & interest costs | € 50,012 | 03.29% | ||

| Total fixed costs | € 1,515,943 | 100% | 62.36% | |

| Costs: variable | Variable staff costs | € 355,170 | 38.95% | |

| Laundry costs | € 118,390 | 12.94% | ||

| Cleaning costs | € 236,780 | 25.88% | ||

| F&B purchase costs | € 204,312 | 22.33% | ||

| Total variable costs | € 914,652 | 100% | 37.63% | |

| Costs: Management Team Decisions | Marketing costs | € 0 | 00.00% | |

| Staff development costs | € 0 | 00.00% | ||

| Extra depreciation costs | € 0 | 00.00% | ||

| Market research costs | € 0 | 00.00% | ||

| Other costs | € 0 | 00.00% | ||

| Total management team decisions costs | € 0 | 100% | 00.00% | |

| Total all costs | € 2,430,595 | 100% |

More info pages on: fixed costs, variable costs and Costs Management Team Decisions.

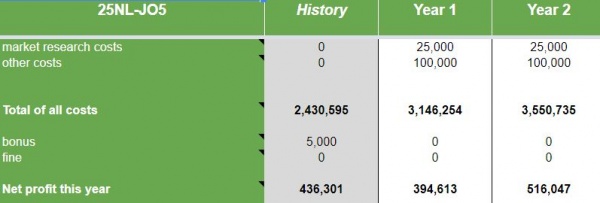

Net profit

Of course, the net profit per year is very interesting. The total costs will be deducted from the total revenues. If there is a bonus (something which turned out much better than expected) or a fine (tax e.g.) this is added or deducted from the profit leading to the net profit.

In this example on taking over:

- Total revenues were € 2,866,902

- Total costs € 2,430,595

- Net profit € 436,301

The balance sheets just show the individual profit of the last year in the operating review and the total of the net profit. Again, in the example a number of predictions for additional costs in the future have been made.

More on this on the page Net profit.

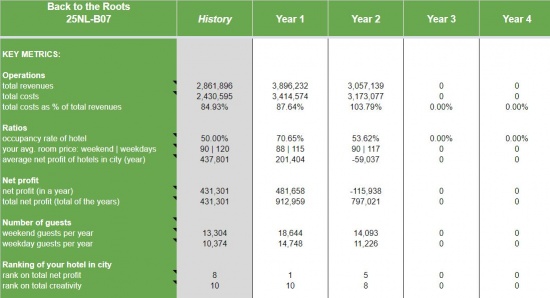

Key metrics

Some key metrics and ratios on the operations of the hotel in this section.

More on this on the page Key metrics.

Analyzing

So the net profit on taking over seems to be 15.21% of the revenues, a good and interesting result. Though, the management did not make enough investments over the recent years, so the depreciation costs have been kind of low. There is no problem with liquidity at all.

Furthermore, the Bergmans did not really consider themselves to be staff, so there are hardly any wages for them in the staff costs. Their income mainly originated from the net profit which they, partly, took out of the company, being the entrepreneurs.

→ Go! Following the Introduction to the Hotel? Step 10/10 is the page Staff

→ GO! Top of this page