Operating review

→ Go! Category:Hotel info

→ Go! Running competition

Your hotels teamsheet in the secure section

We will example the teamsheet of an example team A01 Amstelburg 01 which still has no name. In this example we have filled out all of the years. Of course if you start you will only see year0, the history, filled out with decisions from the past. There is three major parts in the secure section

- the decisions tab

- the explanation link, decision 14: the explanations form

- the results tab

We know look at the results part of the teamsheet.

All results

The results of your hotel will be calculated automatically by the accountant. You just have to analyse them, your do not have to calculate them yourselves. After each year they will be ready for you in the secure section which is only accessible with your secret link.

Your results presented there will be divided into the next parts:

- The results, the operating review with

- The Revenues

- The Costs: divided in costs fixed, costs variable and costs of the teams decisions

- Net profit

- The elements Key metrics, Market information from Top Research and Short commend of your coach are explained in separate pages.

Operating review

Please take into account that your hotel has 364 days (not 365 or a leap year even 366) and some figures are rounded off.

At the end of each year you will find, in the secure section, at the tab results an operating review. Your team (and your coach) are the only ones who can see these results. If a year has passed, you will see your results, as soon as they are released by your coach.

You do not have to calculate anything in this operating review yourselves. You only take the decisions and the rest is automatically calculated for you. An algorithm calculates your occupancy rate depending on your decisions, the market, your coach's mark (related to the quality of your explanations) and other elements. Depending on your occupancy rate, you'll get more food & beverage and other revenues as well.

All the fixed and variable costs will automatically be calculated related to your occupancy rate and your decisions. The costs of your team choices will also be automatically brought to your operating review and will be visible here as well. So the operating review brings you the results.

Revenues

Revenues consist of the average (sales) prices times the number of rooms booked (occupancy rate). You can influence the prices, because you fix them, while the occupancy rate is defined by all of your decisions and your arguments: the mark the coach gives to you for your performing as a team is influenced heavily by this. The maximum occupancy rate would mean all 100 rooms occupied during all days, so 52 weeks x 100 rooms x 7 days = 36.400 room nights. Check the next pages for detailed information on this.

All food and beverages are considered to be caused by these guests: so the higher the occupancy rate, the more revenues you get from food and beverages.

Banqueting is a totally separated unit in the hotel. The sales prices in this market in the past varied from a minimum of €25 to a maximum of €30 per person. You decide on the price of banqueting, so you do have some control. This gives you an indication: on the Banqueting page you can find some more info, pictures and videos on banqueting.

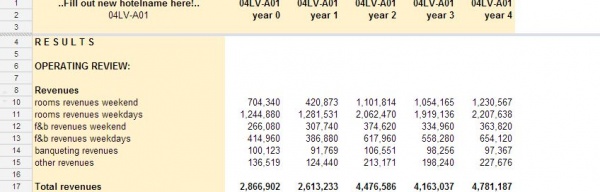

The above situation is just an example of the revenues as they will be shown in the complete operating review. So this example shows the history (column B, year0) which is the same for all teams as they start. After each year the next column (so the next year) will be available and filled out automatically. In this example this is just year 1 in column C. In the example all years have been filled out.

Underneath you'll find an overview which gives some more insights into the revenue structure, as far as information is available in the Bergman's administration. This all reflects the year before you take over, this will be your starting position.

| Revenues History | ||||

|---|---|---|---|---|

| Rooms | Rooms revenues weekend | € 704.340 | 24,56% | |

| Rooms revenues weekdays | € 1.244.880 | 43,42% | 67,98% | |

| Food and beverage | F&B revenues weekend | € 266.080 | 9,28% | |

| F&B revenues weekdays | € 414.960 | 14,47% | 23,75% | |

| Banqueting | Banqueting revenues | € 100.123 | 3,49% | 3,49% |

| Other revenues | Other revenues | € 136.519 | 4,76% | 4,76% |

| Total revenues | € 2.866.902 | 100% | 100% |

Operating review costs

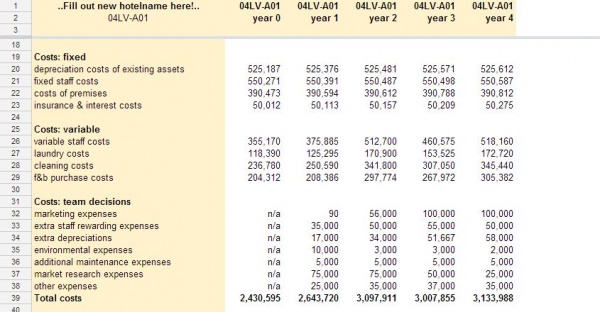

The situation below is just an example of the costs as they will be shown in the final operating review. So this example shows year0 (column B) which is the same for all teams and as you take over. After each year the next column (so the next year) will be available and filled out automatically. In this example this is just year 1 in column C.

Underneath you'll find an overview which gives further insights into the cost structure as far as information is available in the Bergman's administration. This all reflects the situation as you take over, this will be your starting position.

| Costs | ||||

|---|---|---|---|---|

| Costs: fixed | Depreciation costs of existing assets | € 525.187 | 34,64% | |

| fixed staff costs | € 550.271 | 36,29% | ||

| costs of premises | € 390.473 | 25,75% | ||

| insurance & interest costs | € 50.012 | 3,29% | ||

| Total fixed costs | € 1.515.943 | 100% | 62,36% | |

| Costs: variable | Staff variable | € 33o.330 | 38% | |

| variable staff costs | € 355.170 | 38,95% | ||

| laundry costs | € 118.390 | 12,94% | ||

| cleaning costs | € 236.780 | 25,88% | ||

| f&b purchase costs | € 204.312 | 22,33% | ||

| Total variable costs | € 914.652 | 100% | 37,63% | |

| Costs: team decisions | marketing expenses | € 0 | 0,00% | |

| extra staff rewarding expenses | € 0 | 0,00% | ||

| extra depreciations | € 0 | 0,00% | ||

| environmental expenses | € 0 | 0,00% | ||

| additional maintenance expenses | € 0 | 0,00% | ||

| market research expenses | € 0 | 0,00% | ||

| other expenses | € 0 | 0,00% | ||

| Total team choices costs | € 0 | 100% | 0,00% | |

| Total all costs | € 2.430.595 | € 2.430.595 | 100% |

The different costs groups are all mentioned in the operating review table above.

- Costs: fixed

You can't influence these costs. These are costs which will be created no matter what the occupancy rate is. Over the years there can be small fluctuations, but the amounts will stay almost the same.

-Depreciation going concern: depreciations of all the assets especially the building and the inventory.

-Fixed staff costs: staff needed to run the hotel and which have to be paid even if there are no guests at all.

-Costs of premises: costs of maintenance, repairs small adaptions to the building and the parking lots.

-Insurance & interest costs: costs for insurance for staff, building an liability ans costs for mortgage and other loans.

- Costs: variable

The variable costs will depend on the actual number of guests in the hotel so will only be filled out (automatically) after each year is finished. So there is a ratio between occupancy rate and all of these costs.

-Variable staff costs: the more guest you have the more work here will be to be done and the more staff is needed. So additional costs.

-Laundry costs: the more guest the more towels, bed linnen etc. needed.

-Cleaning costs: rooms need to be cleaned more often because of more guest and to be cleaned better.

-F&B purchase costs: more guest mans more breakfasts etc. for guest and more f&b for additional staff so the purchase costs go up.

- Costs: team decisions

Of your 14 decisions number 7 -13 lead directly to expenses which can be seen directly at the costs. The are directly connected to the choices you make in your decisions each year. As you can see in the past there were no expenses on these decisions. Of course this was good for the profit but it will come back like a boomerang! So Christina urges you to use this team costs group team decisions in an efficient way, though she knows this will probably lower the profit!

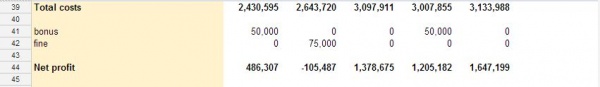

Net profit

The total costs will be deducted from the revenues. If there is a bonus or a fine this is added or deducted from the profit leading to the net profit. There is no VAT or other taxes in the city.

In this case

-Total revenues were € 2.866.902

-Total costs € 2.430.595

-Net profit € 436.307

-There is a bonus in this case so € 50.000 is added

-Net profit € 486.307

So the net profit seems to be 32,8% of the revenues, a good and very interesting result.

But, the management did not make enough investments over the recent years, so the depreciation costs have been kind of low. There is no problem with liquidity at all.

Furthermore the Bergmans did not really consider themselves to be staff, so there are hardly any wages for them in the staff costs. Their income mainly originated from the net profit which they, partly, took out of the company, being the entrepreneurs.